Insurance & Warranty Tips

By getting an insurance policy you get financial protection/reimbursement against losses from an insurance company. There are many different types of insurance.

Home insurance: With a home insurance policy you can get coverage to repair/rebuild your home in case of a fire, theft, vanalism etc. Most insurance policies also provide additional living expenses if your home has been damaged, and coverage for clothing, furniture and other possessions. Having home insurance is not a legal requirement but it is highly recommended.

Motor insurance: With a motor insurance policy you can cover your car, boat, RV, two wheeler/bike, commercial vehicles like taxi, busses and trucks. Did you know that in most states in the U.S. it is illegal to drive without car insurance coverge?

Travel insurance: Travel insurance is a good idea in case you need to cancel your trip due to sickness, job loss or a fligh canellation. It may also cover travel delays, damaged luggage and lost luggage. Having travel insurance is not

required, it's up to you.

Health insurance: With a health insurance policy you can reduce your medical bills to a more reasonable amount. You can get covered for medical expenses such as hositalisation costs, surgery, the cost of your medicine, doctor consultations etc.

Most states in the U.S. requires you to have health insurance. You may have to pay a penalty for not having one.

Life insurance: A life insurance policy is a contract between you and an insurance company as a protection and security for your family. Depending on the policy the insurance will pay a lump sum to your beneficiaries after your death. The money can be used for anything.

Renters Insurance: Renters insurance is a type of insurance policy that provides financial protection to individuals who rent their homes. It covers personal property and belongings in the event of damage or loss due to events such as fire, theft, or natural disasters. It can also provide liability coverage in case someone is injured while on the rental property.

Renters insurance is an important consideration for anyone who rents their home, as it can help to protect their belongings and provide peace of mind. Many landlords require tenants to have renters insurance as a condition of their lease agreement.

Renters insurance policies vary in terms of the coverage they provide and the cost. It is important for individuals to carefully review their policy and understand what is and is not covered. Some common exclusions from renters insurance policies include flooding and earthquakes, so it may be necessary for individuals to purchase additional coverage for these events.

In addition to protecting personal property, renters insurance can also provide coverage for temporary living expenses in case the rental property is uninhabitable due to damage or other events. This can include expenses such as hotel stays and meals.

To obtain renters insurance, individuals can contact their insurance provider or shop around for a policy that meets their needs and budget. It is important to compare policies and review the fine print to ensure that the policy provides the desired level of coverage.

Liability insurance: Liability insurance is a type of insurance that protects individuals and businesses from claims arising from injuries or damage to other people or property. It covers legal fees and any resulting judgments or settlements, up to the limit of the policy.

There are different types of liability insurance, including general liability, professional liability, and product liability. General liability insurance is commonly held by businesses and covers claims arising from accidents or injuries that occur on the insured's property. Professional liability insurance, also known as errors and omissions insurance, covers claims related to mistakes or negligent actions in the course of providing professional services. Product liability insurance protects against claims arising from defects or malfunctions of products manufactured or sold by the insured.

Liability insurance is an important consideration for individuals and businesses, as it can provide protection against financial loss in the event of a claim. It is typically required by law for certain types of businesses, such as healthcare providers and contractors.

In addition to providing financial protection, liability insurance can also offer peace of mind and help to protect the reputation of individuals and businesses. It is important for individuals and businesses to carefully review their insurance needs and choose a policy that provides the desired level of coverage.

Below are some articles that may help you on your way to pick the perfect policy for you.

Insurance Tips

Practices for Maintaining Comprehensive Insurance Protection

December 12, 2025Protect your Ohio home with the right insurance strategy. Learn key coverages, state laws, risk-reduction tips, and documentation practices to ensure strong, reliable protection…

Read More

Insurance Tips

7 Top Home Warranty Companies in Massachusetts

October 16, 2025Compare the 7 top home warranty companies in Massachusetts for 2025. See expert reviews of Liberty Home Guard, Old Republic, AIG, Cinch, HWA, First American, and Select…

Read More

Insurance Tips

Understanding What Insurers Look for in High-Value Properties

July 22, 2025Unlock top-tier insurance for your high-value home. Learn what insurers assess, from unique features and location risks to replacement costs and liability, for comprehensive coverage…

Read More

Insurance Tips

Renters Insurance Myths Debunked: What Every Renter Needs to Know

June 26, 2025Think renters insurance is too expensive, unnecessary, or complicated? Think again. This guide debunks the biggest myths and reveals how affordable, essential, and easy renters insurance…

Read More

Insurance Tips

Leveraging Big Data Analytics for Better Risk Assessment in Insurance

January 21, 2025Learn how big data analytics is transforming the insurance industry by enhancing risk assessment, enabling personalized premiums, detecting fraud, and improving operational…

Read More

Insurance Tips

Key Benefits of Landlord Insurance for Property Owners

December 19, 2024Protect your rental property and income with landlord insurance. Gain coverage for property damage, lost rent, liability, and tenant-related risks. Secure your investment today…

Read More

Insurance Tips

What to Do When Your Insurance Claim is Denied

November 19, 2024Understand common reasons for denial, navigate local legal differences, and explore actionable steps to appeal. Expert guidance on avoiding pitfalls and securing a favorable resolution…

Read More

Insurance Tips

The Ins and Outs of Lenders Mortgage Insurance

September 12, 2024Understanding how LMI works, who needs it, and how to potentially avoid it can save buyers thousands of dollars. Consult professionals to ensure you're making the best financial…

Read More

Insurance Tips

Understanding Condo Master Insurance

July 28, 2024Condo master insurance protects condo buildings' shared spaces, structure, and against liability claims. It's purchased by the HOA and funded through condo fees. How it works…

Read More

Insurance Tips

Maximize Your Renters Insurance: Tips for Choosing the Right Policy

June 3, 2024This article provides tips on how to choose the right renters insurance policy, including comparing options, selecting coverage amounts, and considering discounts…

Read More

Insurance Tips

Guarding Your Investment: Comprehensive Home Coverage

May 09, 2024Homeownership comes with responsibility, and safeguarding your investment starts with comprehensive home insurance. This protects your property from disasters, theft…

Read More

Insurance Tips

Understanding the Role of Title and Title Insurance

January 16, 2024A clear title and title insurance act as the unsung heroes of real estate transactions, protecting buyers, sellers, and lenders from unforeseen ownership problems…

Read More

Insurance Tips

Title Insurance vs. Property Deed: Clarifying the Difference

December 28, 2023Title insurance is a specialized type designed to protect homeowners and lenders from financial loss due to property title defects. A property deed is a legal documents showing…

Read More

Insurance Tips

8 Things You Need To Know About Renters Insurance in Boston

October 16, 2023This article highlights the significance of renters insurance in Boston, addressing cost-effective coverage options, liability protection, and the need for additional coverage…

Read More

Insurance Tips

What is Renters Insurance? Is it Worth is?

August 12, 2023Renters insurance is a type of property insurance that covers your personal belongings and provides liability protection if someone is injured in your rental unit…

Read More

Insurance Tips

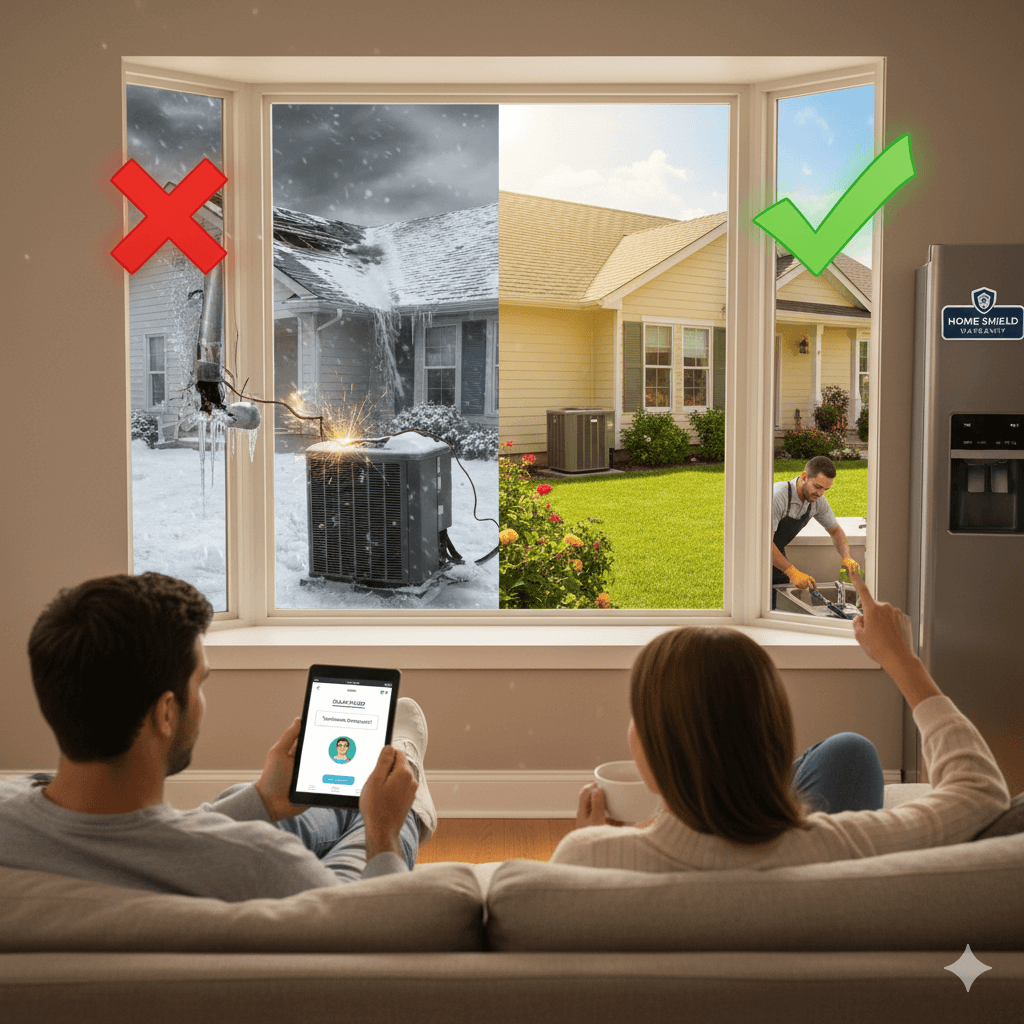

The Best Ways to Save On Appliance Repairs & Replacements

May 31, 2023Save on appliance repairs with an affordable home warranty. It provides financial protection and peace of mind for homeowners, especially for older homes or individuals with specific…

Read More

Insurance Tips

Will homeowners insurance go up after one claim?

March 30, 2023Typical homeowners insurance policies usually cover four types of accidents on the insured asset or property: interior damage, external damage, destruction or loss to private…

Read More

Insurance Tips

Protecting Your Real Estate Investment with Insurance

January 12, 2023Real estate insurance covers liability claims against the homeowner if someone is injured on their property, and It can also cover different types of losses that are due…

Read More

Insurance Tips

Is Car Insurance Mandatory for Drivers in Massachusetts?

November 22, 2022In the state of Massachusetts, all drivers are required to have a minimum of liability insurance. This insurance protects drivers in the event that they cause an accident…

Read More

Insurance Tips

The Main Benefits Of Having Homeowners Title Insurance

July 09, 2022As a homeowner, you want to do everything you can to protect your investment. One way to do that is to purchase homeowners title insurance. Title insurance protects you from …

Read More

Insurance Tips

How to Choose Car Insurance in Massachusetts

June 16, 2022Similar to most other states, Massachusetts requires minimum insurance coverage. You have four compulsory coverage in the state including bodily injury to other people …

Read More

Insurance Tips

6 Types Of Insurance That Cover Real Estate Damage

May 09, 2022Depending on the type of property you own, these are perhaps the most crucial kinds of insurance for you to consider. Options such as flood insurance, general homeowners insurance…

Read More

Insurance Tips

A Better Understanding of the Importance of Property Insurance

May 05, 2022Some people wait until their house has caught fire or their car has been totaled before they realize how much money and hassle they could have saved themselves if they had only been…

Read More

Insurance Tips

By The Numbers: Natural Disasters at Home

March 02, 2022Natural disasters are unavoidable, especially now that the climate is changing. Understanding which disasters affect your home is the first step to protecting yourself from…

Read More

Insurance Tips

4 Tips to Help Choose a Home Warranty Plan

September 26, 2021Home warranties cover various things such as appliances, plumbing, electrical systems, and heating or air conditioning units. You must research your coverage options before signing up for anything…

Read More

Insurance Tips

Simple Tricks To Help You Choose A Perfect Home Insurance

June 09, 2021Living life without insurance for yourself and your properties is a big risk. You never know when disaster can strike so it's best to be prepared for what can happen. Keeping yourself and your …

Read More

Insurance Tips

Make Your Insurance Claim Easier And Faster With These Useful Tips

June 04, 2021As getting in an accident was not tragic enough for you, you often need to go through a ton of bureaucratic paperwork to make the most out of your unfortunate situation. Making …

Read More

Insurance Tips

Benefits of Taking Out a Mortgage Insurance

June 15, 2020If you take out mortgage insurance, it means either purchasing additional coverage from an insurance company or getting rid of it completely. In some instances, it's not practical to continue …

Read More

Insurance Tips

Landlord House Insurance - Residential & Commercial

Whether one is an individual renting out a second home to tentants or a property tycoon with plenty of apartments for rent, whether the property is residential or commercial…

Read More