What to Do When Your Insurance Claim is Denied

Facing a denied insurance claim can be an overwhelming experience. Whether it involves damage to your home, medical expenses, or business losses, the expectation is that insurance will provide financial relief in challenging times. However, when a claim is denied, it can feel like your safety net has vanished. Understanding why claims are denied and how to respond can help you turn the situation around and achieve a favorable outcome.

Common Reasons Claims Are Denied

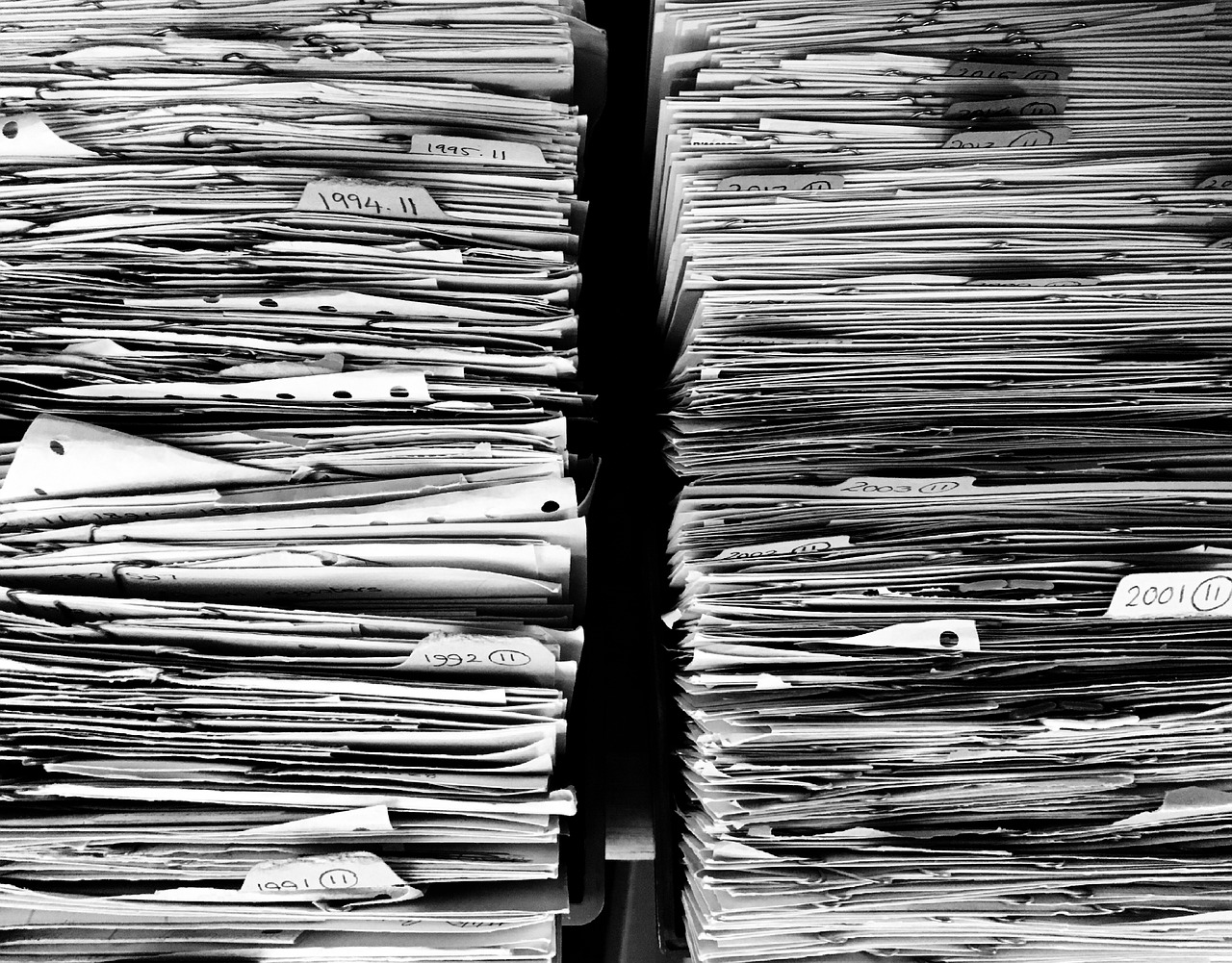

Insurance companies deny claims for various reasons, often tied to the specifics of the policy or the circumstances surrounding the incident. One frequent reason is incomplete documentation. If your claim lacks sufficient evidence—such as photos, receipts, or detailed descriptions—the insurer may find it difficult to approve.

Another factor is policy exclusions, which outline the events or damages that aren't covered. For instance, standard homeowners' insurance might exclude flood damage unless you've purchased additional coverage. Timeliness is another critical issue, as most policies require claims to be filed within a specific period. A delay in reporting can lead to automatic rejection.

Sometimes, the insurer may dispute the cause of damage, arguing that it falls outside the terms of your policy. In such cases, understanding your coverage and the reasons for denial is vital.

Navigating Local Legal Differences

Insurance laws and practices differ from state to state, and these variations can impact how you approach a denied claim. Whether you go to a Miami Property Insurance Lawyer or one in Texas, knowing the local rules can significantly resolve your issue. For example, in Florida, insurers must adhere to strict timelines when handling property claims, especially those related to natural disasters like hurricanes.

In contrast, Texas has its own set of guidelines that may allow more flexibility for insurers but require additional documentation from claimants. Working with a local legal expert ensures that you understand these nuances and apply the appropriate strategies when appealing your claim. They can help you navigate state-specific requirements, negotiate with your insurer, or even take legal action if necessary.

Key Steps to Take After a Denial

If your claim is denied, don't panic. There are several steps you can take to improve your chances of success upon appeal.

Start by requesting a detailed explanation of the denial from your insurance provider. A written statement outlining the reasons for rejection is a critical document that helps you determine whether the denial is valid. Next, review your insurance policy to understand its terms and conditions. Cross-reference the denial explanation with your policy to identify discrepancies or areas where you may need to provide additional clarification.

Gathering supporting evidence is another crucial step. This might include photographs of damages, repair estimates, or any other documentation that bolsters your case. Once you've compiled this information, consider filing an appeal directly with the insurance company. Many insurers have internal processes for reconsidering denied claims, often requiring supplementary evidence or clarification.

For claims involving complex issues, such as disputes over damage causes, consulting an expert—like a public adjuster or a legal professional—can be invaluable. These specialists have the experience to advocate effectively on your behalf.

Avoiding Common Pitfalls

While you can't eliminate the risk of claim denials, there are proactive measures you can take to reduce the likelihood of issues in the future. First, make an effort to understand your policy thoroughly. Familiarize yourself with its coverage limits, exclusions, and any additional riders that might apply.

Keeping detailed records is another essential step. This includes maintaining an inventory of your property, documenting its value, and taking photos of its condition regularly. These records can serve as invaluable evidence if you ever need to file a claim.

Lastly, prompt communication with your insurer is key. Reporting damages or incidents as soon as they occur demonstrates responsibility and ensures that you meet any filing deadlines outlined in your policy.

The Role of Professional Guidance

Sometimes, navigating a denied claim requires expertise beyond what a policyholder can manage independently. This is where professionals come in. Public adjusters specialize in assessing damages and advocating for claimants, while legal professionals can address disputes that escalate into legal conflicts. Seeking their guidance can save time, reduce stress, and improve your chances of securing a favorable outcome.

A denied insurance claim doesn't have to spell the end of your journey for coverage. By understanding the reasons for denial, seeking local legal expertise when needed, and taking deliberate steps to address issues, you can confidently move forward. Being prepared, staying informed, and approaching the process methodically can transform a frustrating experience into a successful resolution.