Four must-see cities for investors

looking to make a profit on condos

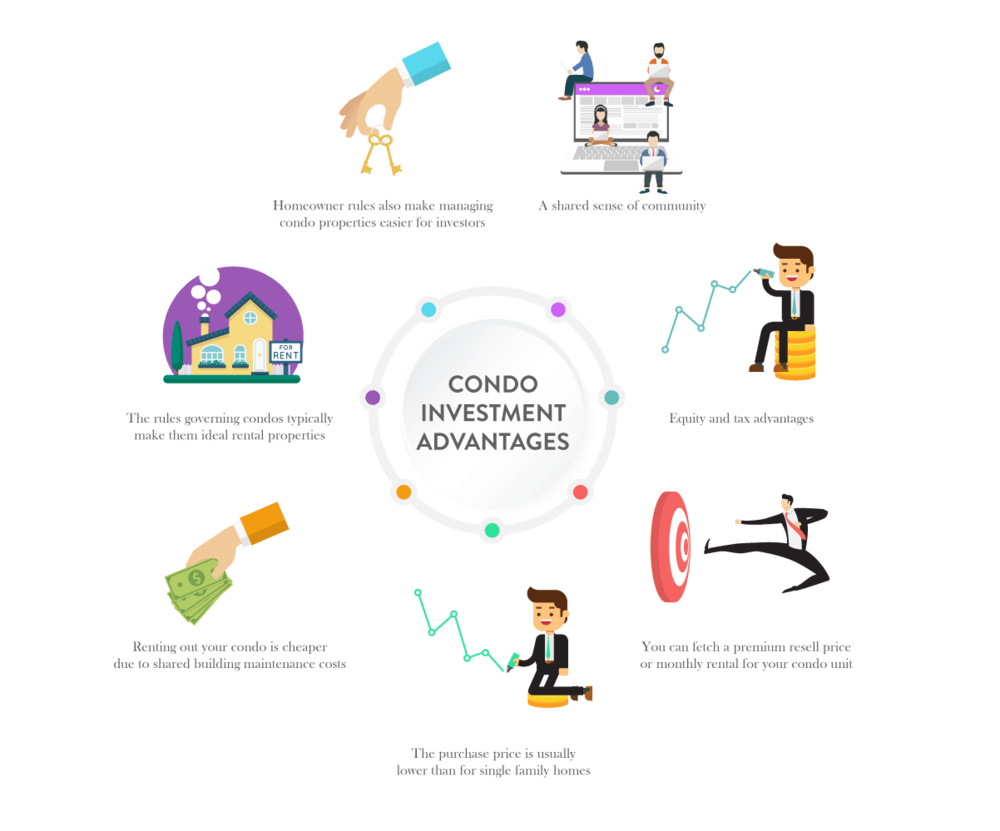

Real estate investment has tested the test of time and proved an intelligent income source option even after a pandemic, higher inflation rate, and risk of other property management. Townhouses and single-family homes can be property investors' liabilities due to HOA renting restrictions, high property taxes, and down payment. In contrast, Condo has a lower price point, renting is allowed, and are often located in a downtown area-ensuring profit for the buyers.

Location is the most vital factor when investing in a condo since the lender options, renovation cost, and Condo association rules change as per state and city council laws. Depending on long-term tenants or short-term renters, a city with scenic beauty is appropriate as a vacation rental condo while prioritizing the location and amenities is essential for regular tenants.

Why condos are significant financial investments?

The high maintenance cost of single-family houses, higher property tax, and the shrinking size of US families increased the demand for condominiums. Rental Condo's property tax is counted as a business tax, ensuring a high yield for the owner.

Four Cities to Bring Solid Income from Condos

St. Petersburg, Florida

Florida is a melting pot of diversified culture, tech employment, economic zone, tourist attraction, and school district. St. Petersburg, FL, is a dream city for condo investors as it has versatile properties: beachfront, low-rise European infrastructure, highrise buildings, and many more. Rather than vacation rentals, fixer-upper condos for long-term tenancy bring great ROI thanks to affordable pricing- starting from $92,000. Considering the furnishing cost of a vacation condo, the renovation cost will be far less.

FL prides itself on offering the best mortgage payment option for first-time home investors below the average income range in the US. The FL Assist and the FL HLP loans help with a $7,500-$10,000 loan to pay the first mortgage or the down payment. St. Petersburg has a renter occupancy rate of 63%-94%, so a condo promises a good ROI (Return on Investment).

Gatlinburg, Tennessee

The rise of Airbnb, and Vrbo, skyrocketed the price of vacation rentals near theme parks, historical monuments, and mountain ranges. Also, the millennials and Gen-Zs are building WFH (work-from-home) communities in remote natural cities to minimize the cost of living. Hence, if you want a steady profit from a rental property near a trendy tourist attraction and nature, invest in a condominium at Smoky Mountain. Out of dozens of Great Smoky Mountain Region cities, Gatlinburg is the most popular among mountaineers, young tech professionals, and nature lovers for being the center of the Smokies and the crossing point of two US states.

Since the city HOA allows short and long-term rentals, a moderately-sized condo at Gatlinburg ensures a good ROI through a 61%-70% occupancy rate. Even though the price range is $296,000-$895,000, you must consider the furnishing cost for a vacation rental.

As per TN lender laws, the down payment is 20% with a mortgage rate of 5%-6% sans the 0% rate for the veterans. However, the average Airbnb rental of $4,062 to $7,833 per month is worth making the condo investment.

Cambridge, Massachusetts

The top Universities of the world- Harvard and MIT- made Cambridge a hub of local and international students and faculty members. The yearly population influx, proximity to top US tech hubs, and inclusive transportation system (walkable, bike lanes, subway, and bus) made the cost of living the highest in the US- a one-bedroom condo rents near Harvard Square for $2500. Hence, the price of condos is increasing exponentially, making it a perfect source of passive income for condo owners who want to live and rent a portion simultaneously.

As an owner-occupier renting one or two rooms of the condo, you will receive a maximum tax reduction of $2,759 in 2023. Unlike HOA, COA doesn't charge extra for air conditioning the unit, snow shoveling, or landscaping which saves bucks as Boston's temperature ranges from 4 °F-100 °F.

Cambridge condos are one of the most expensive properties in the US- a 2-bed condo can go from $600,000 to over a million. However, as a single-unit investment property, the condo down payment of 15% (less than the national average of 20%) with Massachusetts Housing Partnership (MHP) providing minimal interest rates ensures a steady income stream.

Wailea, Maui County, Hawaii

Wailea, located in Maui County, Hawaii, is a premier destination for luxury condo investments. This scenic region is known for its world-class beaches, golf courses, and upscale amenities, making it highly desirable for both vacationers and long-term residents. Wailea boasts a variety of condo options, from oceanfront properties to those nestled in lush tropical landscapes. Investors can expect a high ROI due to the area's strong tourism and affluent demographic.

One of the key advantages of investing in Wailea condos is the stability of the rental market driven by year-round tourism. Whether you opt for a high-end vacation rental or a luxury long-term lease, you can anticipate a steady stream of income. The price range for condos in Wailea typically falls between $600,000 and several million dollars, but this investment often translates into substantial returns. Prospective buyers should explore Wailea condos for sale to find the perfect property that suits their investment strategy. Hawaii's flexible lending options and competitive mortgage rates add to the appeal, with down payment requirements generally around 20%. With its solid infrastructure, excellent rental potential, and idyllic surroundings, investing in Wailea condos offers a lucrative opportunity for those seeking to tap into the luxury Hawaiian real estate market.

The inflation rate and high living costs made regular Americans seek modest rentals rather than buying a massive townhouse. Hence, the market of condos as property investment is the safest way to build wealth and create retirement plans. Learn the market trends, mortgage, and taxes, and study the city laws for rentals, and you will be set to make profits for years.