Water Softening Systems Market Report (2024-2032): Insights, Trends, and Forecasts

Across Canada and globally, concerns about hard water are growing due to its long-term impact on infrastructure, appliances, and health. Therefore, water purification has become a practical necessity for everyone nowadays.

Water softening systems are one of the most effective solutions to address these issues. Their rising popularity is reflected in strong global market performance, technological innovations, and growing awareness about water quality.

This report presents a comprehensive analysis of the water softening systems market, including current size, trends, competitive landscape, and future outlook through 2032.

Market Overview and Definition

Water softening systems are filter systems designed to eliminate hardness minerals, primarily calcium and magnesium from water. These minerals are not hazardous to human health but can have a significant impact on plumbing systems, reduce appliance lifespan, and affect the efficiency of soaps and detergents. The adoption of these systems has grown significantly in both residential and industrial sectors over the past decade.

As water hardness becomes increasingly prevalent, especially in urban centers, households and businesses alike are recognizing the value of integrating softening solutions into their water purification infrastructure. According to recent data, approximately 85% of homes in North America, including large parts of Ontario and Alberta in Canada, have hard water. This statistic has driven steady demand for water softeners, which has, in turn, propelled market growth.

Market Size and Growth Forecast

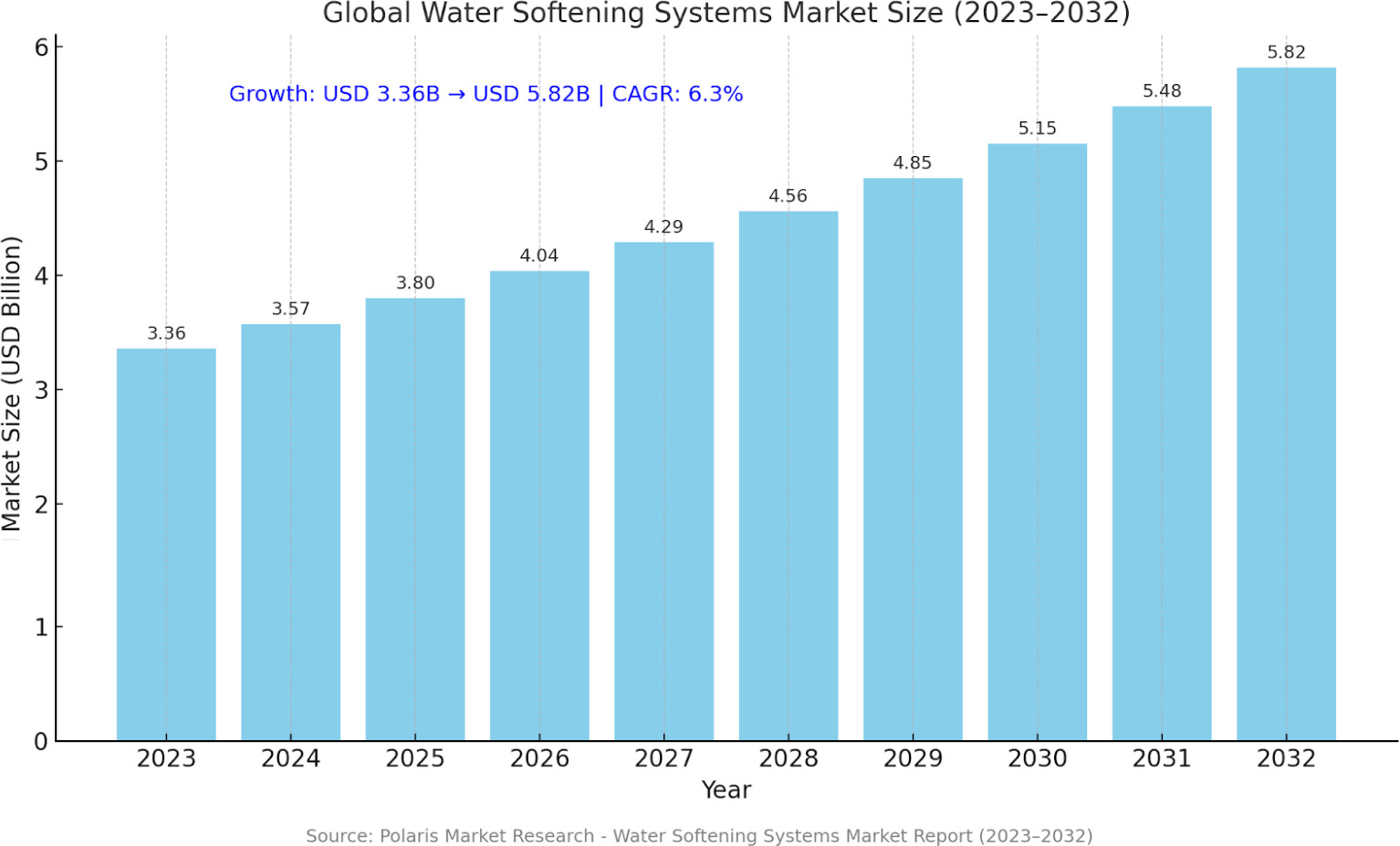

According to Polaris Market Research, the global water softening systems market is projected to grow from USD 3.36 billion in 2023 to USD 5.82 billion in 2032, reflecting a compound annual growth rate (CAGR) of 6.3% during the forecast period.

The graph below illustrates the projected market size over the coming years:

This growth is driven by increasing awareness of the benefits of water-softening systems and ongoing technological advancements. It is also supported by the rising demand for clean and safe water across residential, commercial, and industrial sectors.

This consistent growth indicates that water softening systems are not only a reactive solution to water quality problems but are becoming a proactive part of water purification planning for modern households and facilities.

Market Drivers Supporting Adoption

Several core factors are driving demand for water softening systems globally and particularly in developed countries such as Canada. Among them is the rising incidence of hard water in municipal water supplies. As population growth continues to strain existing water infrastructure, the quality of supply often declines and increases mineral content in tap water.

In addition, the trend toward environmentally sustainable living is influencing consumers to invest in technologies that reduce long-term resource use. Water softeners help reduce soap and detergent consumption, lower energy bills by improving heater efficiency, and minimize the frequency of appliance replacement. These benefits align well with sustainability goals in both homes and commercial environments.

Furthermore, the rise of smart home technology has paved the way for more advanced water-softening systems. Today, consumers can find units that feature app-based monitoring, leak detection sensors, automated regeneration cycles, and even real-time reporting on water usage and quality.

Key Market Segments and Applications

The water softening systems market is segmented by type, end-user, and region.

By Type

The market is primarily segmented into salt-based, salt-free, and magnetic descaling systems.

Salt-based softeners remain the dominant choice due to their high efficiency in removing hardness minerals like calcium and magnesium. However, salt-free and magnetic descalers are steadily gaining traction, especially in areas where environmental regulations restrict salt discharge into wastewater systems.

By End-Use

- Residential Applications account for the largest market share. Households, particularly in suburban and rural areas of Canada, are increasingly installing whole-house water softening systems. These systems are often used in combination with filtration and reverse osmosis units to ensure comprehensive water treatment.

- Commercial Installations are also expanding, especially in hotels, laundromats, and healthcare facilities, where water quality impacts both service efficiency and customer satisfaction.

- Industrial Sector: Water softening systems are used in industries like food and beverage, chemical manufacturing, and power generation. Although growth in this segment is moderate, it is supported by rising environmental standards and machinery performance requirements.

By Region

- North America, led by the United States and Canada, holds a significant share of the market due to the widespread presence of hard water and high adoption rates in both residential and commercial spaces.

- Europe follows closely, driven by stringent environmental laws and growing awareness about water quality.

- The Asia Pacific region is expected to witness robust growth fueled by rapid urbanization, industrialization, and increasing demand for advanced water treatment solutions.

- Latin America and the Middle East & Africa are emerging markets, with rising investments in infrastructure and water management systems contributing to future market expansion.

Competitive Landscape and Industry Players

The water softening systems market is competitive, with several established players dominating global and regional segments. Key companies include:

- WaterMart - A trusted Canadian leader in home and commercial water purification, providing tailored solutions with advanced technologies and expert support.

- Culligan International - Known for its wide range of salt-based and salt-free softeners and a robust dealer network.

- EcoWater Systems LLC - A subsidiary of Berkshire Hathaway, offering highly customizable residential solutions.

- Pentair plc - Offers industrial-grade water softening and filtration technologies.

- GE Appliances (Haier) - Manufacturer of modern, digitally-integrated home softeners.

- A.O. Smith Corporation - Expanding its reach with smart home-compatible purification solutions.

These brands continue to invest in R&D and focus on features such as low-salt use, compact designs, and connectivity with home automation platforms.

Challenges and Barriers to Growth

Despite the strong market outlook, several challenges persist. The initial cost of installation remains a significant barrier for some consumers, especially for high-capacity or commercial systems. Additionally, in areas with limited plumbing infrastructure or where municipal treatment already softens water, market penetration may be lower.

There is also increasing scrutiny of salt-based systems, as they contribute to brine discharge that can affect wastewater treatment and environmental quality. As a result, manufacturers are exploring alternative technologies, including template-assisted crystallization and capacitive deionization.

Future Outlook: Sustainable Growth and Technological Innovation

Looking ahead, the water softening systems market is poised for stable and sustainable growth. Integration with broader water purification and filtration systems is becoming the norm. Smart home compatibility, predictive maintenance alerts, and energy-efficient regeneration processes are expected to become standard features.

Canada's aging infrastructure, combined with a growing consumer base focused on health, sustainability, and home value retention, ensures that demand for reliable water treatment solutions will continue to rise steadily. Government programs that offer incentives for water-efficient systems may also further boost adoption in the residential sector.