Selling Wisely:

Tax Tips for Vendors to Optimize Profits

Being a freelancer or business owner and marketing goods or services may be very profitable, but there are tax obligations involved as well. To ensure that you keep as much of your hard-earned money as possible, it is imperative that you maximize your tax savings and file your taxes accurately. We'll talk about some tax tips for sellers in this post to assist you manage the complicated tax code and optimize your profits.

Having an understanding of 1099 Misc Forms

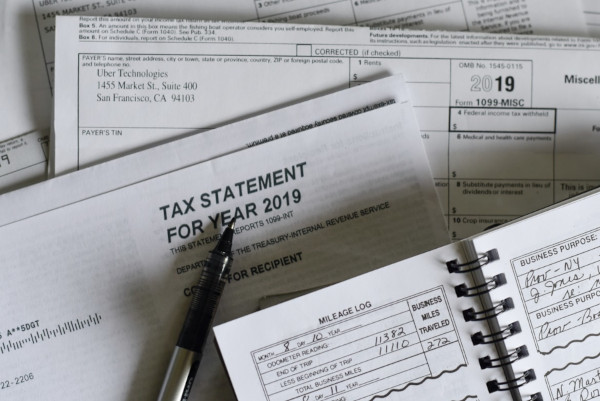

The 1099 Misc form is one of the most important tax paperwork that sellers should be knowledgeable with. Reports of revenue received as an independent contractor or freelancer are made using this form. During the tax year, if you receive payments from a single customer or firm totaling $600 or more, they must provide you with a 1099 Misc form.

It's crucial that you maintain track of all of your 1099 Misc documents and appropriately report this revenue on your tax return. The IRS may impose penalties and fines for failure to comply. To keep yourself out of trouble with the IRS, make sure you thoroughly check all of your 1099 Misc papers and accurately report the revenue.

Making Use of a Self-Employed Tax Estimator

As a self-employed person, figuring out your taxes may be difficult and time-consuming. Consider utilizing a self-employed tax calculator to make things easier. Based on your income, deductions, and other details, these online tools can assist you in estimating the amount of taxes you owe.

You may also use a self-employed tax calculator to find out if you have to pay anticipated taxes on a yearly basis. Maintaining your tax responsibilities and avoiding underpayment penalties depend on doing this. Utilizing a self-employed tax calculator helps eliminate uncertainty in your tax computation and guarantee that you are paying the correct amount.

Estimating and Paying Taxes

Paying taxes as a self-employed person is your responsibility all year long instead of all at once during tax season. Herein lies the role of projected tax payments. These payments are based on your anticipated year income and are made on a quarterly basis.

The IRS may impose fines and interest costs for late filing of estimated taxes. Make sure you precisely calculate and file your anticipated tax payments on time to avoid these penalties. Observe your payments and make the necessary adjustments to reflect any modifications to your income or deductions.

Getting Expert Assistance

As a seller, navigating the tax system can be confusing, particularly if you are not familiar with tax rules and regulations. It might be wise in certain situations to get expert assistance from an accountant or tax counselor. These experts may offer insightful direction and counsel on how to optimize your tax savings and ensure that your taxes are properly filed.

In addition to helping you prepare and file your tax return, a tax counselor may help you find credits and deductions for which you may qualify. They may also assist you in creating a tax plan that supports your financial aims and objectives. Although there may be a cost associated with hiring a tax expert, it is definitely worth it for the possible savings and piece of mind they can offer.

In conclusion, meticulous planning and close attention to detail are necessary to maximize your tax returns as a seller. You may confidently handle the complexity of taxes by being aware of important tax papers such as the 1099 Misc form, using a self-employed tax calculator, paying anticipated taxes, and getting expert assistance when necessary. To make sure you are optimizing your tax savings and retaining more of your hard-earned money in your pocket, don't forget to maintain organization, maintain correct records, and remain up to date on changes in tax legislation.