7 Best 529 Plans Massachusetts 2026 for Tax-Advantaged College Investment Options

529 basics and the new 2026 rulebook

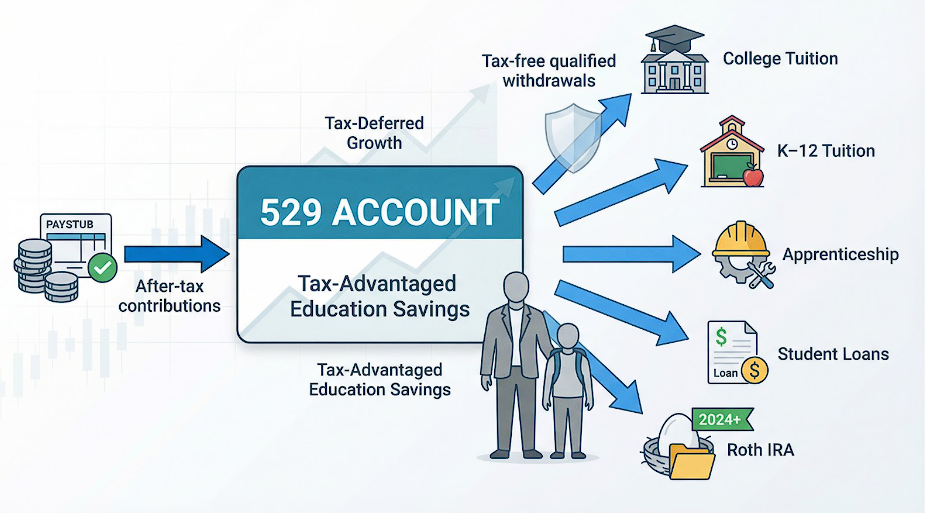

A 529 plan is a tax-advantaged education account: you invest after-tax dollars, earnings grow tax-deferred, and qualified withdrawals come out free of federal and Massachusetts income tax.

Congress established the accounts in 1996, and while that core benefit remains unchanged, the list of qualified expenses keeps expanding. You can now put up to $10,000 per year toward K-12 tuition, cover apprenticeship fees, or even pay down student-loan principal. Starting in 2024, a lifetime maximum of $35,000 in leftover funds can roll into the beneficiary's Roth IRA—preserving the tax shelter for retirement instead of tuition.

Contribution limits are equally generous. Most leading programs accept more than $500,000 per student, letting high-income families front-load years of savings without hitting a ceiling.

The IRS allows one investment strategy change per calendar year, plus another whenever you change the beneficiary, which keeps rebalancing straightforward while discouraging day-trading.

Crucially, the money belongs to you, the account owner. You remain in control even if your student takes a gap year or lands a full scholarship.

With those fundamentals covered, we can turn to the extra perks Massachusetts offers—and the elite out-of-state plans that pair well with them.

Massachusetts tax perks you don't want to miss

Living in the Bay State brings built-in savings for higher education.

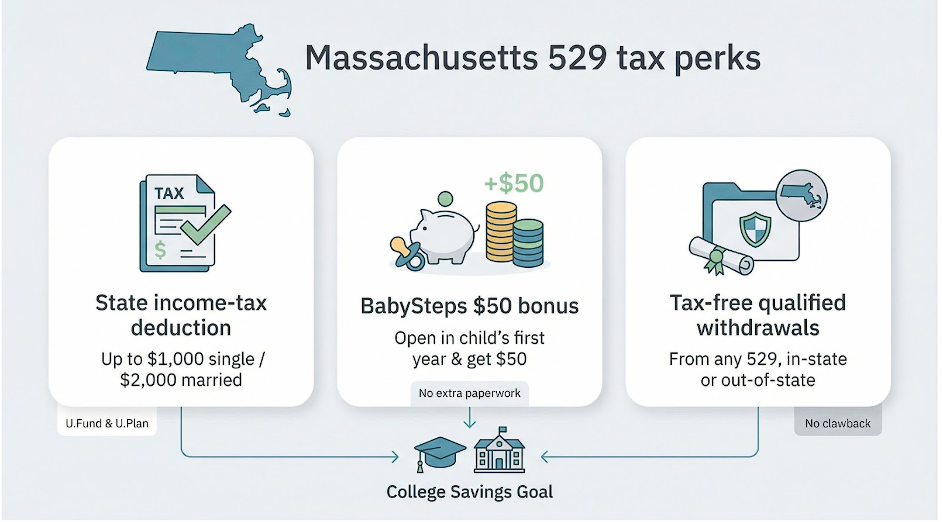

First, contributions to the U.Fund or U.Plan qualify for a Massachusetts income-tax deduction. Singles may deduct up to $1,000 per year, and married couples up to $2,000, trimming roughly five percent off those amounts—an easy $50 to $100 credit for money you already planned to invest.

Second, new births and adoptions trigger an automatic boost. Open a 529 during the child's first year, and the BabySteps program deposits $50 into the account with no extra paperwork. That seed begins compounding alongside your own contributions from day one.

Massachusetts also waives state tax on qualified withdrawals from any 529, whether the money sits in the home-state plan or, say, Utah's. You can pursue lower fees elsewhere without risking a future tax clawback.

Together, these incentives deliver modest dollars and strong motivation. They reinforce disciplined saving, reward consistency, and show that the Commonwealth shares your goal of sending a student to campus.

With the local advantages covered, let's look at how we compared the nation's best plans.

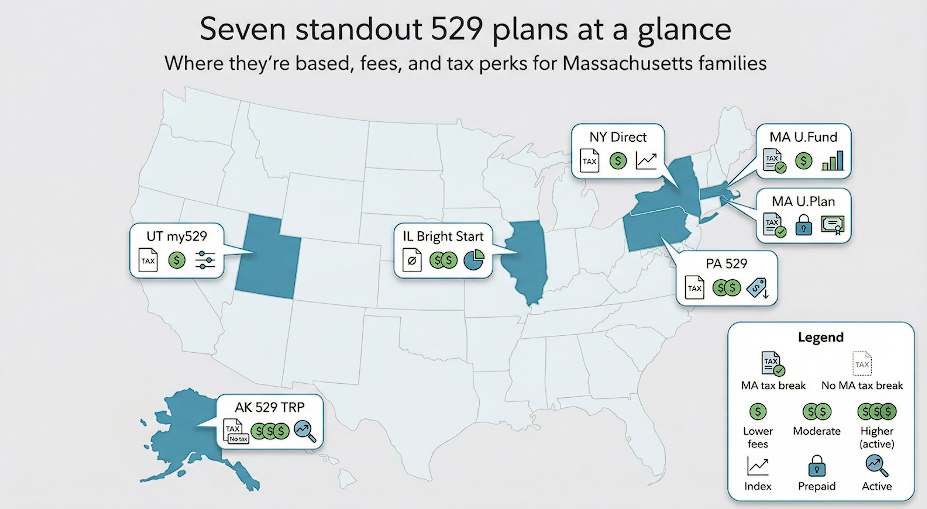

How we chose the seven standout plans

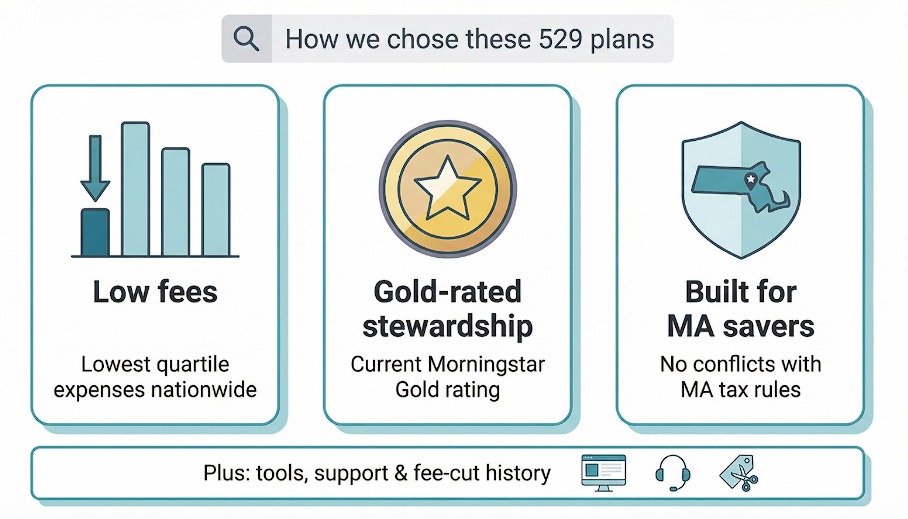

Selecting a 529 often feels like comparing phone plans. Small fee gaps hide behind glossy brochures, so we relied on three hard metrics and a practical quality check.

Fees come first. Every basis point you keep stays in your child's account, so we focused on plans whose total expenses rank in the lowest quartile nationwide.

Next, stewardship. Morningstar's annual medal report grades oversight, investment process, and results. We included only plans that hold a current Gold rating, the firm's highest confidence level.

Third, fit for Massachusetts savers. A rock-bottom fee loses value if the plan piles on state taxes or restricts college choice. Each plan on our list is open to everyone and works smoothly with the Bay State deduction you just read about.

We also reviewed each plan's website tools, call-center ratings, and history of fee cuts. A provider that supports families today and keeps trimming costs is more likely to stay competitive through freshman year and beyond.

Illinois Bright Start 529

Bright Start is widely viewed as a low-cost leader. Managed by TIAA, the plan blends Vanguard, BlackRock, T. Rowe Price, and Dimensional funds in both age-based and static tracks, giving you broad diversification without multiple accounts.

Recent fee cuts pushed the indexed age-based portfolios near 0.12 percent, so more of every deposit compounds for tuition instead of covering management costs. For many savers, that edge can offset the $100 Massachusetts tax break once annual contributions reach several thousand dollars.

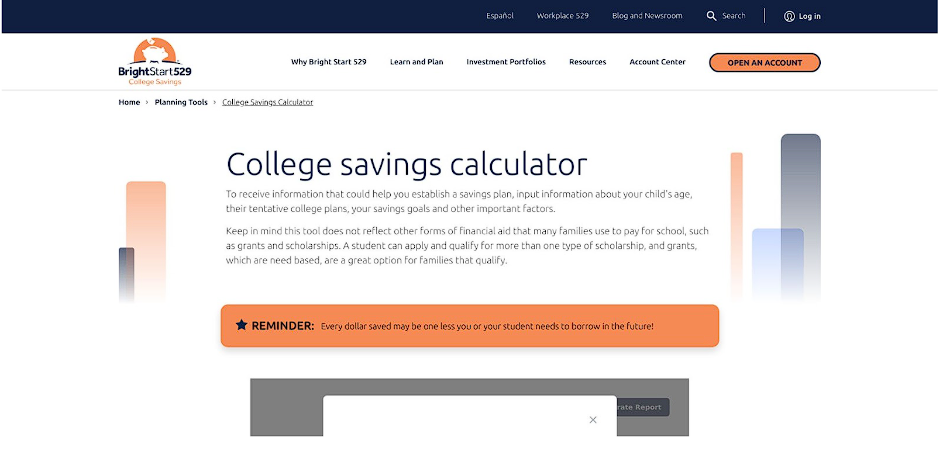

To see exactly what Bright Start's low fees translate to in real dollars, you can use its interactive tool to calculate how much to save for college. Enter your child's age, an estimated tuition cost, and a target enrollment year, and the calculator models future growth, potential shortfalls, and the monthly deposit needed to close any gap. It also projects how steady contributions compound over time.

If you prefer wide investment choice and ultra-thin expenses, and you are comfortable forgoing the state deduction, Bright Start deserves a spot on your short list.

Massachusetts U.Fund College Investing Plan

The U.Fund is the home-field advantage for Bay State families. Fidelity manages the portfolios, MEFA provides guidance, and together they keep index-fund expenses near 0.10 percent on the passive age-based track.

Two extra perks sweeten the deal. Contributions up to $2,000 per year reduce your state income tax, worth about $100 for most couples. Open an account during your child's first year, and the BabySteps program adds $50 of seed money that can compound for nearly two decades.

Investment choice feels balanced. Choose a hands-off glide path, build your own mix from 11 static options, or place short-term cash in an FDIC-insured sleeve. Costs stay low even in Fidelity's actively managed funds, so you keep quality without sacrificing price.

For many Massachusetts savers, the U.Fund is the default starting line, keeping fee hawks and performance chasers comfortably close to home.

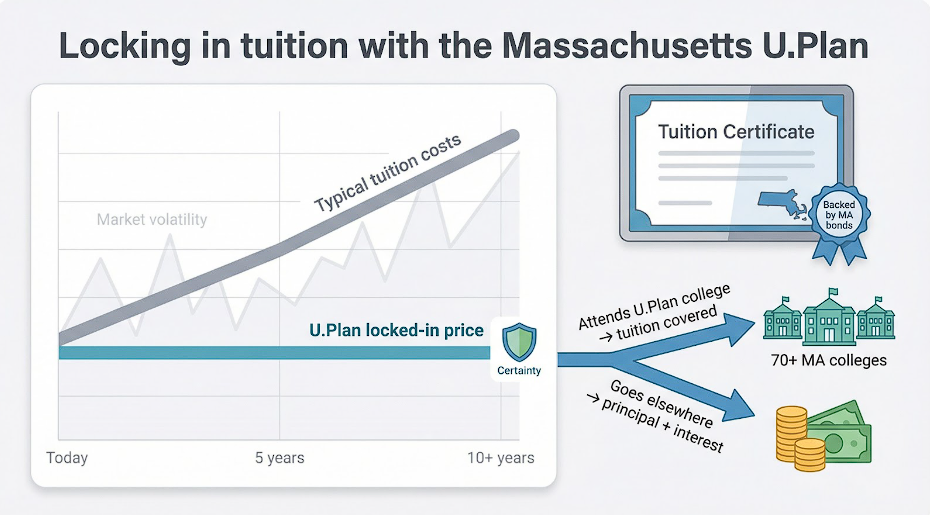

Massachusetts U.Plan prepaid tuition program

The U.Plan trades market swings for certainty. Instead of investing, you prepay a slice of future tuition at more than 70 Massachusetts colleges, locking today's prices in place.

Your dollars purchase Tuition Certificates backed by state general-obligation bonds. When college arrives, each certificate covers the same percentage of tuition you prepaid, regardless of how high the bill climbs.

If your student selects a school outside the network, you receive the full principal plus bond interest, with no penalty. Combine that flexibility with the same state tax deduction available to the U.Fund, and conservative savers gain a clear path to outpace tuition inflation.

The compromise is growth potential. Bond returns lag long-term stock gains, and certificates pay only tuition, not housing or books. Many families split the strategy: secure a core portion of tuition with the U.Plan and use a traditional 529 for everything else.

Utah my529

Utah's my529 keeps costs almost invisible. Most index portfolios charge about 0.12 percent, so a $10,000 balance pays roughly $12 in annual expenses.

Customization is the headline feature. You can create a personal mix of Vanguard and Dimensional index funds, set your own glide path, or add an FDIC-insured sleeve for late-stage safety. Hands-on investors can tilt toward small caps, expand international exposure, or apply ESG screens without leaving the 529 umbrella.

If you prefer a set-and-forget approach, the preset age-based tracks deliver a solid blend of simplicity and price. Select aggressive, moderate, or conservative, and the plan rebalances automatically. Either route preserves the Roth-conversion option and nationwide qualified use.

Utah offers no state tax break for nonresidents, yet its lean expenses often outweigh the $100 Massachusetts deduction once annual contributions exceed a few thousand dollars. For families focused on maximum growth and comfortable making their own adjustments, my529 stands out.

New York 529 Direct plan

New York's direct-sold plan shows how simplicity reduces costs. Each portfolio holds Vanguard index funds, and the program recently trimmed its total expense ratio to about 0.11 percent, placing it among the lowest nationwide.

The menu stays intentionally streamlined with three age-based tracks, several static blends, and an FDIC-insured savings option. This lean lineup helps you concentrate on steady contributions rather than constant tweaks.

Massachusetts residents do not receive a state tax deduction, yet they share New York's scale benefits. With more than $30 billion under management, any future fee cuts apply equally to out-of-state owners. If you prefer set-and-forget indexing and near-invisible costs, the Empire State plan merits a close look.

Pennsylvania 529 Investment plan

Pennsylvania trimmed expenses three times in two years, and its Vanguard-based lineup now costs about 0.15 percent—lower than roughly 80 percent of competing plans. Age-based “target enrollment” portfolios glide from stocks to bonds each year, while static options range from all-equity to socially responsible blends.

Morningstar awards the plan a Gold rating, citing the state treasury's active oversight and commitment to lowering costs. For Massachusetts investors who favor Vanguard funds and prefer an annual glide adjustment, Pennsylvania delivers that nuance without an extra price tag.

Although out-of-state savers receive no local tax break, the plan's disciplined governance and bargain pricing make it a strong satellite alongside a U.Fund core.

Alaska 529 T. Rowe Price college savings plan

Alaska offers disciplined active management. T. Rowe Price runs the age-based portfolios with a goal of outpacing broad indexes. Recent expenses average about 0.45 percent, higher than a pure index plan yet modest for an active strategy that has recorded periods of outperformance.

The account retains every standard 529 benefit: nationwide availability, no sales loads, and tax-free growth on qualified withdrawals. Investors gain access to T. Rowe Price's research team and a glide path that reduces risk ahead of several past market downturns.

For Massachusetts savers, Alaska fits best beside an index-heavy core. Think of it as adding an actively managed sleeve to your retirement mix, offering a potential source of added alpha without disrupting overall cost control.

Side-by-side snapshot

Comparing plans in prose helps, but a single view is faster. The table below lists state tax perks, fees, ratings, and standout features so you can decide which plan fits your saving style.

| Plan | State tax break for MA residents | Typical all-in fee | Morningstar rating | Signature feature | Contribution cap |

|---|---|---|---|---|---|

| Illinois Bright Start | No | ≈ 0.15 percent | Gold | Multi-manager fund mix | $500,000 |

| Massachusetts U.Fund | Yes, up to $2,000 deduction | ≈ 0.10 percent (index) | Gold | $50 BabySteps grant | $500,000 |

| Massachusetts U.Plan | Yes, up to $2,000 deduction | Bond yield, no asset fee | Not rated | Locks tuition at 70+ MA schools | $300 minimum per bond year |

| Utah my529 | No | ≈ 0.12 percent | Gold | Build-your-own portfolio tool | ≈ $660,000 |

| New York Direct | No | ≈ 0.11 percent | Silver | Vanguard index simplicity | ≈ $520,000 |

| Pennsylvania 529 | No | ≈ 0.15 percent | Gold | Ongoing fee-cut trend | ≈ $511,000 |

| Alaska 529 (TRP) | No state income tax | 0.30-0.60 percent | Gold | Actively managed age-based funds | ≈ $475,000 |

Conclusion

Use this cheat sheet to highlight the column that matters most to you—fees, management style, or tax relief—and the right plan often becomes clear.

Published 1/21/26