Guide on how to Report Foreign Property Rental Income

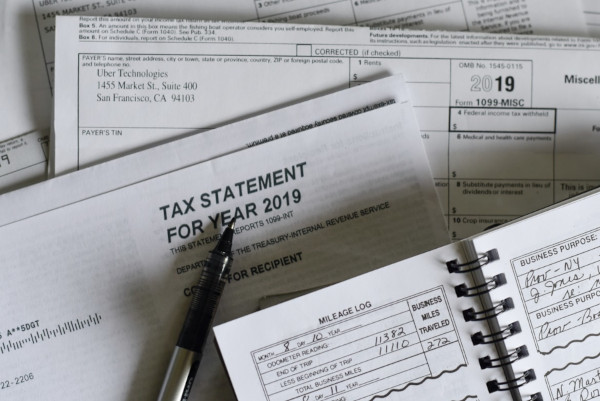

All income earned by citizens and permanent residents of the United States must be reported to the Internal Revenue Service; whether it is earned within or from outside the United States. So if you have rental property in another country, you must file a Schedule E alongside your Form 1040 to disclose your foreign rental income; else, you will be subject to a penalty.

So, are you interested in renting out your beach house in Europe or an Airbnb in Canada? And you wish to learn how to file your rental income from abroad with the IRS. There are US tax concerns to keep in mind and these tax requirements can be complex. Why? The IRS regulates how many days a person can use their property for rental purposes.

In this article, we will guide you on how to report foreign property rental income in a simple manner. We will highlight some of the rules for foreign rental income. And also, we compared Foreign vs. American tax advantages; to give a clear picture of what you are doing.

Rules for Foreign Rental Income

Income from renting out your property in another country is known as "foreign property rental income" and the following rules govern you in filling your foreign rental income:

- Renting your home for 14 days or less, or 10% of the total rental period.

- Renting your house for up to 14 days (2 weeks) a year is exempt from income tax. The IRS doesn't care if you charge $3,000 per night for 14 days. The IRS considers your property a personal residence, allowing you to deduct mortgage interest under the second home rules, but not rental losses or expenses.

- Renting out your home for 15 days or more. Thus, the IRS considers your home a rental property and your rental activities a business. Unless you charge rent, a family member using your house counts as a personal day. For example, you can deduct foreign property taxes and mortgage interest from your rental revenue.

Foreign vs. American Tax Advantages

A few anomalies apart, owning real estate outside the United States and benefiting from tax breaks is very similar to doing so here at home. Property owners in the United States are taxed according to how they use their land. Mortgage interest, liability insurance, and maintenance costs can all be deducted if they rent out their home.

Mortgage interest, upkeep, repairs, utilities, insurance, management fees, and depreciation can all be deducted by Americans residing abroad. Depending on the rental start date, a dwelling abroad depreciates between 30 and 40 years, but a home in the United States depreciates between 5 and 10 years (27.5 years). You just depreciate the building's worth in every situation.

Reporting Foreign Rental Income

Here's how to report overseas rental income gains and losses to the IRS.

- Convert your international earnings into USD. And you can use the best online translation companies to translate documents written in foreign languages into English. Then, for tax purposes, you need to know how many days you resided in or rented out your property over the year:

- Foreign Rental Loss Reporting: You must still record international rental losses on your US tax return. The only distinction is between foreign and domestic rental property depreciation. Your overseas property is depreciated over 30 or 40 years. Instead of 27/5 years for US residential properties.

- In addition to Schedule E, it is possible that your foreign rental property will require the filing of extra papers. It is necessary to file Form 114 (commonly known as the "Overseas Bank Account Report" or "FBAR") if you receive any money from an overseas rental account. Form 114 is available online. If you fail to file an FBAR or if you file an incomplete FBAR, you will be subjected to substantial financial penalties.

- It is possible that you will be required to file either Form 8865 or Form 5471 as part of your federal income tax return if you are a foreign legal entity, such as a foreign business or an international partnership. If you rent out a property in another country, you may learn more on how to become a real estate agent abroad and to complete Form 8858 as well.

Conclusion

Any and all rental income must be reported to the Internal Revenue Service. Even if you have a negative net income from your foreign rental property, you must still file Schedule E to record the rent you received as well as any deductions you incurred. This is the only way you can escape any form of punishment.

Bio

Barbara Fielder is an independent and passionate writer. She works with several reputable platforms and blogs. She's also an explorer that loves traveling, and she speaks 3 different languages fluently. She looks forward to helping her readers with her writing and research skills.